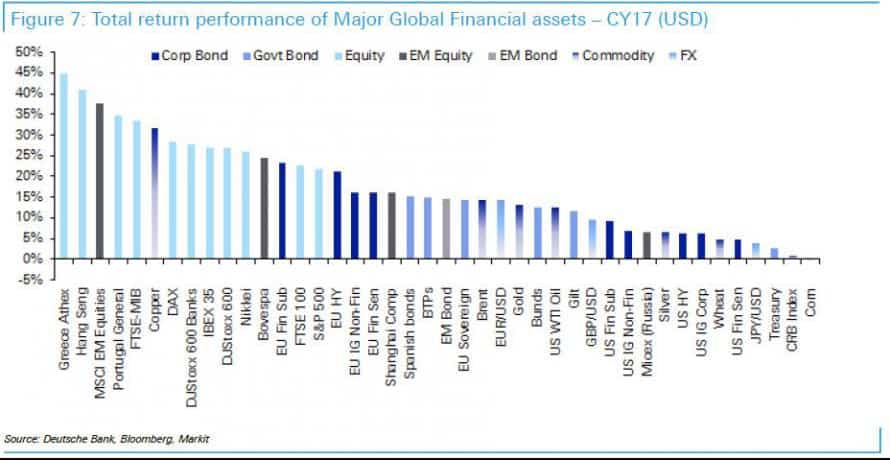

Most people know that stock markets across the globe had a great year in 2017. Few people take the time to review what didn’t work in the past year. This chart from Deutsche Bank helps us visualize the returns (in US dollars) of various asset classes across the globe.

Personally, my “invest-able” asset classes are as follows: US stocks, International Developed stocks, Emerging Market stocks, high quality global bonds, real estate (Real Estate Investment Trusts included) and cash. You can find all of these asset classes on this list except for REIT’s (up about 6% in 2017*) and cash. Cash was the worst performing of the major asset classes in 2017, returning whatever your money market fund pays in your account (I believe my Chase checking account gets me 0.2% currently). As you can see, if you would have put your money almost ANYWHERE other than cash in 2017 you would have done much better – including Greek stocks, copper and Spanish bonds!

Cash may start gaining traction with investors in 2018, however. Money market funds and savings accounts are raising their yields as the Federal Reserve continues to hike short term rates. I have seen some savings accounts offering yields around 1.4%, which looks pretty sweet if you are worried about high valuations in other asset classes.

Investors moving to cash in 2018 should remember that inflation is not your friend. The current twelve month inflation rate is 2.2%** so even if you can get a yield of 1.4% on cash, you still lose 0.8% per year in purchasing power. Recent economic data here in the US seems to indicate that inflation is rising, not falling – not helping the case for cash as an asset class in 2018.

There will be a time where cash is king again and maybe 2018 is that year. But if global stock markets continue to rally in 2018, cash my be at the bottom of the return barrel yet again.

** https://www.bls.gov/news.release/cpi.nr0.htm

***The above article is informational in nature only and is not a recommendation to buy or sell securities. All information is gathered from sources believed to be reliable, but neither Charles Brown nor Ausdal Financial Partners, Inc guarantees the accuracy of the information. All investments carry a degree of risk. Individuals should consult with their tax and investment professionals before making changes to their investment portfolios.

****Securities and Investment Advisory services offered through Ausdal Financial Partners, Inc, 5187 Utica Ridge Road, Davenport, IA 52807 (563)326-2064. Member: FINRA/SIPC. M.Brown and Associates and Ausdal Financial Partners are independently owned and operated