– By Charles Brown, M. Brown Financial Advisors, May 18, 2021

Have you ever seen the movie War Games (1983)? The film, which stars Matthew Broderick, Dabney Coleman, John Wood, and Ally Sheedy, follows David Lightman (Broderick), a young hacker who unwittingly accesses a United States military supercomputer programmed to predict and execute nuclear war against the Soviet Union*. At the end of the movie (spoiler alert!), the supercomputer realizes that the many different scenarios (games) involving a nuclear attack all end with the entire world being destroyed – which leads to this comment by the sentient computer…

I love that line: “the only winning move is not to play”. Many people compare investing to gambling, and there are many similarities between the two. There is one big difference, however. When you are at a casino playing blackjack, for instance, as long as you are at the table you are required to play (bet) every hand. In investing you do not have to play every hand. If you think a stock is overvalued you can decide not to own it. If you don’t understand a recent trend or industry, you can choose not to own it. If you think stocks are overvalued you can sit in cash until the risk/reward characteristics are more in your favor. You can choose not to play.

For many people, staying invested in a well-diversified portfolio will help them reach their retirement/investing goals. Different asset classes will go from undervalued to overvalued and back again, but the portfolio should grow and compound at a reasonable rate over time. However, there are still some “games” to played or not played when it comes to a “buy and hold” portfolio.

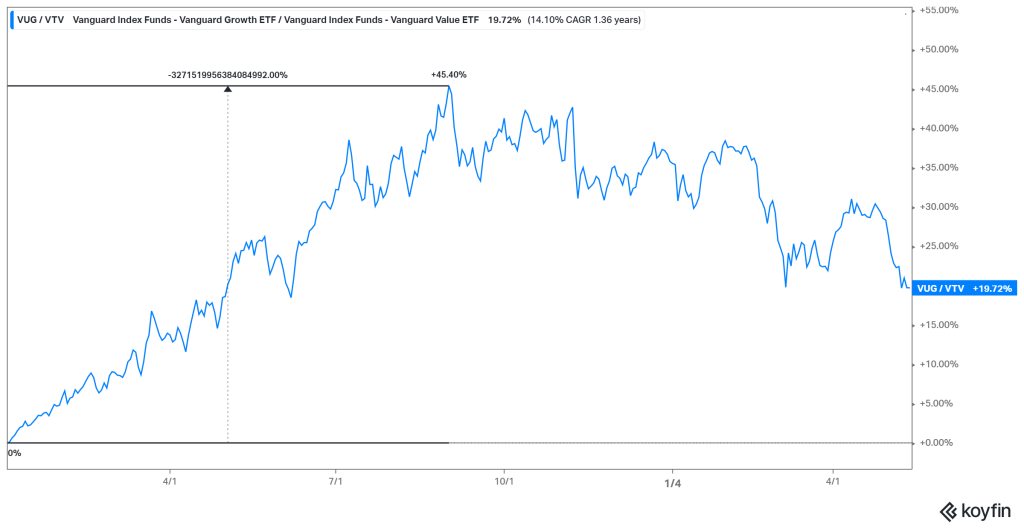

Game 1 – Growth versus Value

The chart above represents the relative performance of US growth stocks ($VUG) when compared to US value stocks ($VTV) since January 1st, 2020. Growth stocks are companies growing revenue at a high rate like many of the technology companies we have today. Value stocks look cheap when using any number of financial metrics like price to book ratio – energy and financial stocks are two sectors that tend to fall in the “value” camp today. During 2021 growth stocks were the darlings of Wall Street outperforming value stocks by a whopping 45% at one point. Starting in September of 2020 value stocks started to outperform and that outperformance has continued into 2021.

If you try to play the “growth vs value” game in your portfolio you may end up losing – what can look like a multi-year trend can easily reverse for no particular reason at all. The S&P 500 ($SPY) is an index that holds the top 500 stocks in the US by market capitalization. Because it is diversified it owns a good mix of BOTH value and growth stocks. You can continue placing bets on growth versus value – or you can choose not to play by simply owning the S&P 500.

Game 2 – Hedged versus Unhedged International Stocks

The chart below represents the relative performance of hedged international stocks ($HEFA) when compared unhedged international stocks ($EFA). When you purchase a stock on the German stock exchange for example, that stock is priced in Euro’s. To buy the stock in Germany you must sell your dollars and buy Euro’s. This unhedged trade is essentially two bets – one on the stock and one on the Euro as currency. Some investors may decide that they want exposure to the stock but they do not want exposure to the Euro – those investors can “hedge” that currency risk by selling Euro’s and buying US dollars in a separate transaction via derivatives markets. It sounds complex but many Exchange Traded Funds and mutual funds do this for their clients in a very efficient manner. As a US investor, the decision to hedge or not hedge your currency risk is basically a bet on the US Dollar. If the dollar declines in value versus a foreign currency then you would rather own the international stock unhedged – if the dollar appreciates versus the foreign currency the you will do better in the hedged version of the stock.

As you can see from the chart, hedged international stocks have outperformed unhedged international stocks over the last five years. But the ups and downs of this chart show that it has not been a steady path. Each strategy has gone through periods of outperformance over the last five years. You can place your bets on what will happen to the US dollar over the next five years, or you can choose not to play this game. One way to not play is simply to pick hedged or unhedged and stick with it over time. The other is to split your international exposure in half by investing 50% in hedged international and 50% in unhedged international – this should nullify any foreign currency movements in your international stock positions.

The stock market and its promise of great returns often lures investors into “games” with their portfolios. Although the games look easy to win, they are very difficult to get right. The great news for any investor is that there are options for you if you decide not to play.

Charles Brown is a CERTIFIED FIANNCIAL PLANNER™ and Financial Advisor at M. Brown Financial Advisors in Naperville, Illinois.

*From Wikipedia – link here

**The above article is informational in nature only and is not a recommendation to buy or sell securities. All information is gathered from sources believed to be reliable, but neither Charles Brown nor Ausdal Financial Partners, Inc guarantees the accuracy of the information. All investments carry a degree of risk. Individuals should consult with their tax and investment professionals before making changes to their investment portfolios.

***Securities and Investment Advisory services offered through Ausdal Financial Partners, Inc, 5187 Utica Ridge Road, Davenport, IA 52807 (563)326-2064. Member: FINRA/SIPC. M.Brown and Associates / M. Brown Financial Advisors and Ausdal Financial Partners are independently owned and operated.