– By Charles Brown, M. Brown Financial Advisors, December 15, 2021

With 2021 winding down, all eyes are on what will happen to markets in 2022. Let’s start with the very basic fact that no one knows what the future holds – but it sure is fun to guess! I would think that COVID’s effect on markets in 2020 and 2021 would have humbled the most confident market prognosticators (or at the very least taught everyone else that those guys really have no clue). Although I have no idea how 2022 is going to shake out, I do think that there is one thing we can expect next year: higher volatility.

Take a look at this chart of the S&P 500 index* for calendar year 2021 through 12/7/21. What do we notice? Well its up, and to the right, so that tells us the S&P 500 is doing well so far this year . We also notice that there have not been too many bumps in the road. I have marked the three biggest selloffs throughout the year on the chart. None of these selloffs were bigger than 6% from top to bottom.

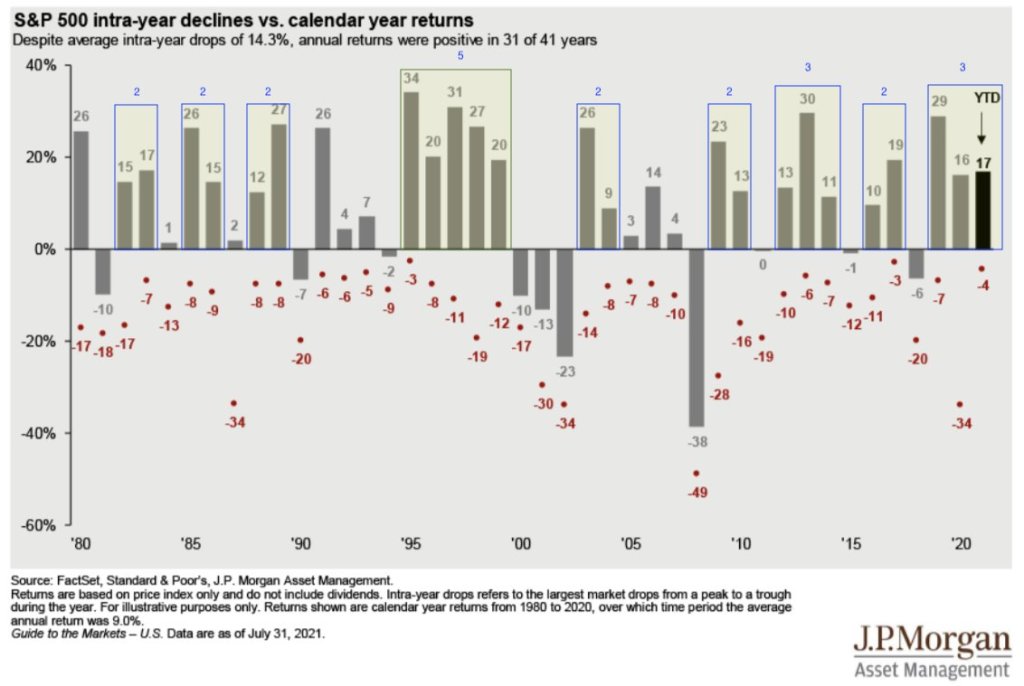

We all know that the US stock market has historically gone up over time, but are these 6% bumps in the road average in any given year? This next chart shows the annual return for the S&P 500 index going back to 1980. It also shows the largest intra-year drawdown (red dots – highest point to the lowest point at any given time in the year). We can see that even though the S&P 500 was positive in 31 out of 41 years, that you had to sit through some pretty large intra-year drawdowns in order to get those returns. In fact, the average intra-year drawdown from this time period is 14.3%.

The drawdown of 6% (as of 12/7/21) in 2021 is small in comparison to the average drawdown of 14.3%, which is why investors should expect higher volatility (volatility rises as stocks sell off) in 2022. Will 2022 be more volatile than 2021? No one knows. Should we understand that 2021 was especially a “smooth-ride” for investors in the S&P 500. Yes. Should we be prepared for bigger swings next year? Probably.

Charles Brown is a CERTIFIED FIANNCIAL PLANNER™ and Financial Advisor at M. Brown Financial Advisors in Naperville, Illinois.

*The S&P 500 is an index. You cannot invest directly in an index.

**The above article is informational in nature only and is not a recommendation to buy or sell securities. All information is gathered from sources believed to be reliable, but neither Charles Brown nor Ausdal Financial Partners, Inc guarantees the accuracy of the information. All investments carry a degree of risk. Individuals should consult with their tax and investment professionals before making changes to their investment portfolios.

***Securities and Advisory Services offered through Ausdal Financial Partners, Inc., an SEC registered investment adviser, member FINRA & SIPC. 5187 Utica Ridge Rd., Davenport IA 52807, 563-326-2064, www.ausdal.com. Sub-advisory services offered through M. Brown Financial Advisors, a registered investment adviser with the state of Illinois. M. Brown Financial Advisors is located at 2728 Forgue Drive, Suite 100, Naperville, IL 60564, 630-637-8600. M. Brown Financial Advisors and Ausdal Financial Partners are unaffiliated entities and only transact business in states where they are properly registered, or are excluded or exempt from registration requirements. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission or any state regulators. Ausdal Financial Partners, Inc. does not accept buy, sell or cancel orders by email, or any instructions by e‐mail that would require your signature. Information contained in this communication is not considered an official record of your account and does not supersede normal trade confirmations or statements. Any information provided has been prepared from sources believed to be reliable but does not represent all available data necessary for making investment decisions and is for informational purposes only.