I really try not to play the “value vs growth game” when managing client portfolios (think Exxon and AT&T when you hear “value”, think Apple and Amazon when you hear “growth”). I call it a “game” because games have winners and losers and when you pick value or growth, you are either going to win or lose in a given time period. I think the less decisions you are required to make while managing a portfolio, the better. For US stocks, the S&P 500 currently has a good “blend” of value and growth so that you really own both at the same time. Owning a “blended” index makes sense to me – it keeps my clients diversified and it keeps me from being tempted to jump from value to growth and back again.

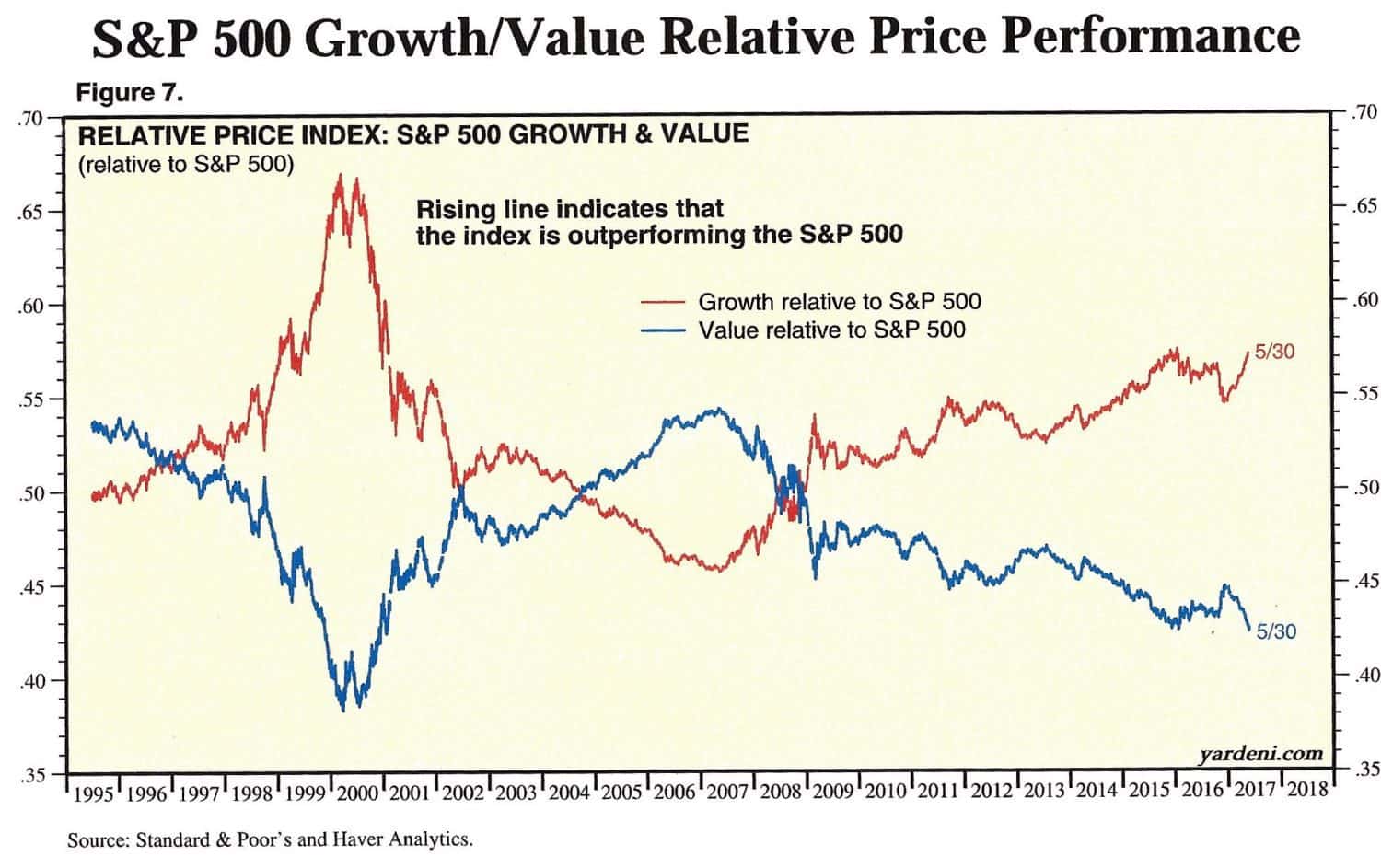

That being said, I find the chart below very interesting.

As you can see, growth stocks have outperformed value stocks significantly since 2007 – a decade-long trend. The “spread” between growth and value has only been greater once before, during the tech bubble of 2000. Said another way, value has not been this “cheap” compared to growth since 2000. Another observation is that growth vs. value trends can last a very long time – value was in favor from 2000 to 2007, then fell out of favor for the next ten years.

We have no idea when this trend will turn. If we are heading into a 1998/1999 scenario, growth could still have years of out-performance remaining before value takes over. We also have no idea why this trend will turn. Will a recession cause investors to buy value stocks again? Will the Facebook’s and Amazon’s of the world suddenly fall out of favor with investors? Needless to say, the ‘growth verses value” debate is getting very interesting. If you own a “blended” index or fund, this is food for thought and not much more. If your portfolio has a bias one way or another, it may be a good time to reevaluate.

*The above article is informational in nature only and is not a recommendation to buy or sell securities. All information is gathered from sources believed to be reliable, but neither Charles Brown nor Ausdal Financial Partners, Inc guarantees the accuracy of the information. All investments carry a degree of risk. Individuals should consult with their tax and investment professionals before making changes to their investment portfolios.