By: Charles Brown, M. Brown Financial Advisors, August 27, 2020

If you have not already heard, this is an election year. LOL. With the S&P 500 already precariously high (new ALL TIME high set on 8/24/2020), fierce campaigning and uncertainly surrounding the election are sure to send the stock market significantly lower. Did I also mention that there is a pandemic going on? Wouldn’t it be a good decision to sell stocks now to side-step the volatility to come?

Maybe. Let’s take a look at historical returns surrounding elections to give us some perspective. Here are the average market returns since 1950 listed by presidential term year*.

- Year after the election: +6.5%

- Second year: +7.0%

- Third year: +16.4%

- Fourth year: +6.6%

Any election year would be the “fourth year” so returns have been positive historically in election years. The returns are almost the same for the year after the election. On the surface, there is nothing here that makes me want to sell today. Election year returns are nicely positive in spite of the election and the returns after the election are good as well.

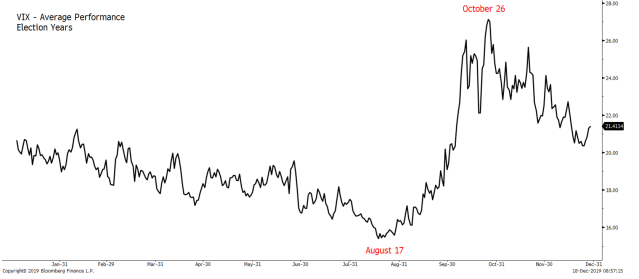

But those returns are for the entire year. What about the months leading up to the election? They must be filled with volatility and large market sell-offs. Let’s take a look at the volatility of the S&P 500 during election years since 1988**.

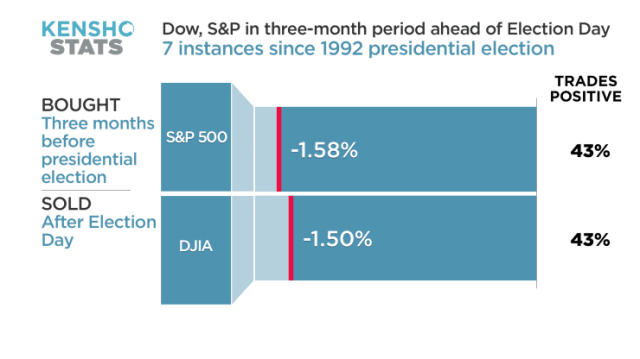

We can see from this chart that volatility does indeed rise significantly starting in mid-August – eventually topping out around the election date then decreasing significantly into year-end. So does this chart tell us that we should sell today and avoid the volatility that has historically surrounded US elections? Again, let’s see what history tells us***.

This tells us that if we chose to sell our stocks three months before the election and then purchase them back the day after the election, we would have avoided losing around 1.5% of our account value. Not bad, but not great either. I would have thought the market would be down much more than an average of 1.5% in the time leading up to the election. Which brings me to my final point.

This tells us that if we chose to sell our stocks three months before the election and then purchase them back the day after the election, we would have avoided losing around 1.5% of our account value. Not bad, but not great either. I would have thought the market would be down much more than an average of 1.5% in the time leading up to the election. Which brings me to my final point.

The stock market does not like uncertainty but it hates surprises even more. The thing about the election is that it is on the calendar. Everyone can see it coming. It’s not a surprise. This simple fact gives money managers and large institutions plenty of time to hedge their portfolio risks. When the election is over, the hedges roll off and life goes back to normal. This is why elections tend to be a “non-event” for Wall Street and why you are most likely not going to save/make yourself a fortune by trying to trade the outcome. By the time the election comes, no matter which side wins, the uncertainty disappears and the stock market gets back to business as usual.

COVID-19 was such a devastating blow to the financial markets because it was a surprise. No one was hedging for that specific risk and when the risk became evident to the market everyone had to hedge/sell/adjust at the same time. The same can be said for the 2008 financial crisis. The upcoming election is definitely an uncertain time, but it is NOT a surprise. History shows us that elections can lead to increased volatility, but that large market losses during this time are anything but certain. Long term investors should weigh the reward of side-stepping election-induced volatility against the risk of missing out on the historically good returns realized in election years and post-election years.

*from https://www.investopedia.com/terms/p/presidentialelectioncycle.asp

**from bloomberg.com – average VIX (volatility index) price during election years since 1988. Higher VIX reading corresponds with higher realized volatility in the S&P 500 index.

***from Kensho / CNBC https://www.cnbc.com/2020/08/10/how-the-dow-sp-trade-in-the-three-months-ahead-of-election-day.html

****The above article is informational in nature only and is not a recommendation to buy or sell securities. All information is gathered from sources believed to be reliable, but neither Charles Brown nor Ausdal Financial Partners, Inc guarantees the accuracy of the information. All investments carry a degree of risk. Individuals should consult with their tax and investment professionals before making changes to their investment portfolios.

*****Securities and Investment Advisory services offered through Ausdal Financial Partners, Inc, 5187 Utica Ridge Road, Davenport, IA 52807 (563)326-2064. Member: FINRA/SIPC. M.Brown and Associates / M. Brown Financial Advisors and Ausdal Financial Partners are independently owned and operated.